Forecastr Through a VC’s Eyes: From Portfolio Pain Points to Scalable Solutions

Accelerates boardroom discussions and decisions

Dramatically shortens the fundraising timeline

Partner with financial

modeling experts

Patrick Henshaw is the Managing Director of Render Capital, a Louisville-based venture firm that invests in early-stage startups across the Midwest and beyond. With a background spanning engineering, special operations, and company building, Patrick brings a pragmatic, founder-first perspective to every investment decision. Having been both a startup operator and now an investor, he knows firsthand the challenges founders face in building high-growth companies.

Render Capital’s mission is clear: deploy catalytic capital into underrepresented regions and back diverse founder profiles. But they don’t just write checks; they roll up their sleeves and work closely with founders to scale businesses with operational rigor from day one.

That’s exactly why Forecastr caught Patrick’s attention. “We’re always looking for tools that help our founders build smart, scalable companies. Forecastr wasn’t just a product – it was a painkiller for a very real problem we see in the early-stage world.”

Patrick saw in Forecastr a rare combination: a deep understanding of startup pain points, a team that had lived through those challenges, and a product that delivered clarity where there was once confusion.

His experience as both an operator and investor gave him a unique appreciation for solutions that don’t just promise scalability – they enable it. “You can spot the difference between a tool designed in a vacuum and one built from lived experience,” he noted. For a firm like Render Capital, where execution matters as much as vision, that made Forecastr an immediate standout.

|

Location: Lousiville, KY |

Why Forecastr Was a Smart Bet

When Patrick Henshaw first came across Forecastr, he wasn’t simply looking at another SaaS tool; he was evaluating a solution to one of the most common pain points in his portfolio.

“We kept seeing the same pain across our portfolio,” he said. Founders with great ideas and strong teams, but no way to confidently project the financial future of the business. They were building plans in spreadsheets that didn’t scale and lacked the visibility to make smart trade-offs.”

Forecastr stood out because it didn’t just solve the modeling challenge; it also removed the operational burden that comes with financial planning. “There’s a big difference between handing a founder a tool and giving them a strategic finance partner,” Patrick said. “Forecastr does both.” The platform offered more than just forecasts – it gave founders structure, support, and a way to confidently communicate with investors.

About Render Capital

For a venture firm like Render Capital, which invests at the seed and Series A stages, this kind of support is a game-changer. The clarity Forecastr brings has a ripple effect, sharper decision-making, stronger board communication, and better team alignment. In Patrick’s view, that’s the real value: turning financial planning from a founder’s weak spot into one of their biggest competitive advantages.

A Tool the Whole Portfolio Can Benefit From

Patrick Henshaw didn’t invest in Forecastr just for Render Capital’s financial return; he saw a way to give his entire portfolio a stronger foundation for growth. As a venture firm backing early-stage startups, Render often works with founders who excel in product, engineering, or mission, but aren’t finance experts. That gap can lead to misaligned expectations, shaky board communications, and costly missteps during fundraising.

|

VC Profile |

|

|

Home: Louisville, KY |

|

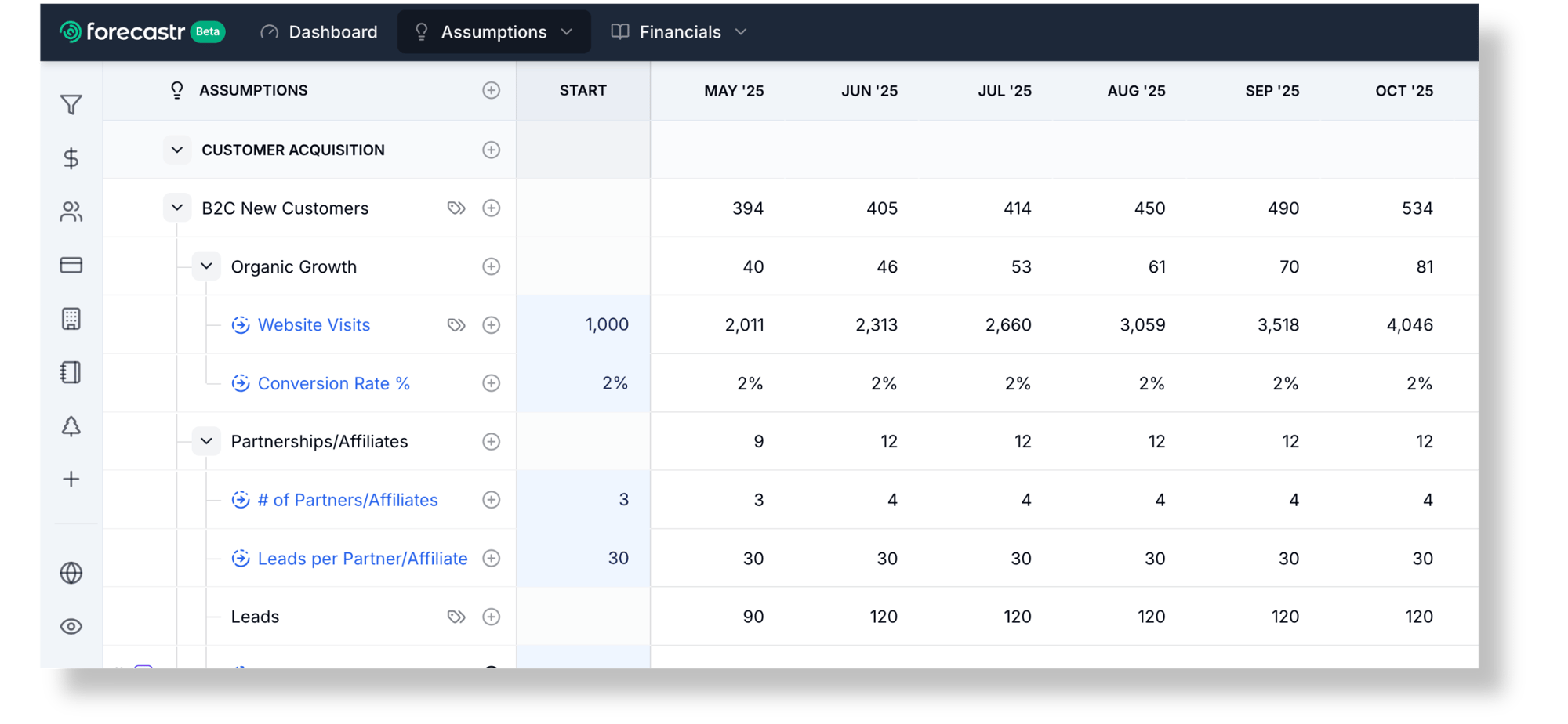

Forecastr closes that gap with intuitive financial modeling software and hands-on strategic finance support.

“Most founders are incredibly talented, but very few are financial modeling experts,” Patrick said. “Forecastr meets them where they are. It helps them understand their own numbers and make decisions with clarity and confidence.”

Today, several Render portfolio companies now use Forecastr, and Patrick has seen the results firsthand. For some, it creates immediate clarity around burn and runway. For others, it becomes the backbone of investor updates or board reporting. Across the board, it’s a strategic asset. “This isn’t a tool that gets bought and then shelved,” he said. “It’s part of the operating rhythm.”

He also sees Forecastr’s services as a differentiator, especially for startups that don’t yet have a full finance function in place.

For a venture firm like Render Capital, which invests at the seed and Series A stages, this kind of support is a game-changer. The clarity Forecastr brings has a ripple effect, sharper decision-making, stronger board communication, and better team alignment. In Patrick’s view, that’s the real value: turning financial planning from a founder’s weak spot into one of their biggest competitive advantages.

More Than a Vendor: A Trusted Strategic Partner

For Patrick, what separates Forecastr isn’t just its product – it’s the way the team shows up. “You can tell the team has viscerally felt the pain points that founders are going through,” he said. “They’ve lived this, and it shows in how they operate.”

That empathy translates into action. Whether it’s helping a founder prep for a raise, clarifying runway during uncertain times, or aligning financial targets with strategic goals, Forecastr brings consistency, speed, and care to every interaction. Patrick emphasized that it’s not simply about being responsive – it’s about being dependable.

“I don’t have to wonder if they’re going to deliver. I know they will,” he said. “That gives me confidence when I refer them to founders.”

Forecastr's financial modeling platform

In a world where startups are flooded with vendor pitches and point solutions, Patrick sees Forecastr as a rare standout. They bring a balance of strategic vision and tactical execution, backed by a team that treats founders like true partners, not transactions.

“They’ve built a strong culture and a strong product,” he said. “That’s rare.”

| "Forecastr is absolutely essential. Every fundraising round—A through G—hinges on the model. We invest in the future, and that future must be backed by a real, evolving forecast." | |

|

- Patrick Henshaw |

|

A Clear Recommendation to Early-Stage Founders

For Patrick Henshaw, the value Forecastr delivers is undeniable, especially for early-stage founders, where financial clarity can be the difference between scaling and stalling. He’s seen firsthand how the right strategic finance partner can help a company unlock growth, align leadership, and raise capital with confidence.

“If you’re an early-stage founder who wants to understand your business and make better decisions, Forecastr is a no-brainer,” Patrick said. “They don’t just provide software. They show up with support, strategy, and the lived experience of helping companies grow the right way.”

His advice to founders is simple: prioritize financial clarity early. “Whether you’re bootstrapped or raising capital, you need a solid model and a team that can help you understand it. That’s what Forecastr delivers.”