5 Critical assets you need for series A fundraising

If you’re a founder preparing for your Series A funding, you might be feeling a bit overwhelmed. The list of things you need to do is growing rapidly...

6 min read

Steven Plappert

January 7, 2022

Steven Plappert

January 7, 2022

If you’re a founder with a new business concept, there’s a good chance you’re already working on a shiny pitch deck for your Series A funding.

You’re setting the stage to wow investors with PowerPoint finesse and entrepreneurial poise.

Inevitably, you’re going to have a few questions about which slides should be included in your final pitch deck and which should be cut out.

There’s a fine balance between overwhelming investors with too many details and omitting a critical detail that could sway an investor’s opinion.

This post will help you find that sweet spot so you can impress investors and lock in that big series A funding round. We’ll share a proven outline, and some simple guidelines to help get you there.

Let’s get started!

Your pitch deck is one of the first points of contact you have with potential investors. It sets the tone for the whole relationship and creates a strong first impression of your business.

Most investors will not waste their time on a deck with too much information, not enough information, or disorganized content.

Achieving the perfect introduction to investors through your pitch deck requires you to toe that fine line between too much and too little information.

It’s about the conversation you have with your investors, and whether or not they choose to engage in that conversation. At the end of the day, it’s a huge factor in whether or not you successfully complete your series A funding.

Here’s how to do it.

You may have enough excitement to talk about your startup for 30 slides or more, but your investors do not (at least not yet).

Limiting your deck to about 10 slides helps ensure that you only share the most critical information.

It’s actually better if your investors are left with some questions. Questions mean they’re engaging with your presentation.

You don’t need to create a slide deck worthy of an art museum.

Too much emphasis on design and detail can detract from the meat of your presentation. However, your presentation should absolutely look clean and professional.

If you’re not design-savvy, consider using a deck builder like Slidebean.

The following 10 slides should definitely be in your series A pitch deck.

Depending on your business model and unique conditions, a few more slides may be necessary. As we stated above, shorter is always better.

The slides below helped Airbnb absolutely crush their seed round.

Thanks to our awesome friends at Slidebean for providing the visuals. You can actually download an editable template of this entire presentation from their website: get a copy.

Your first slide should include your company name and logo, and probably not much else.

You may want to include some contact information or a pithy description of your business, like Airbnb’s “Book rooms with locals rather than hotels.”

This slide should be clean and simple. Your primary objective is to set a professional tone for your presentation.

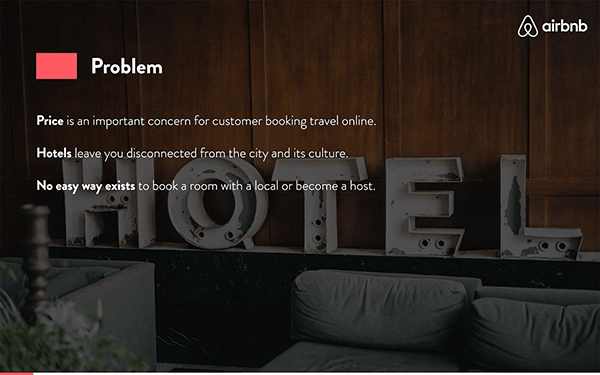

What problem does your business solve? This slide should pique the interest of your investors and allow them to start building trust.

If your investors do not relate to or agree that the problem exists, why would they invest in a solution that solves it?

Like the Airbnb example below, a few bullet points should sufficiently summarize the customer pain points. Your description of the problem should include plenty of detail, but your slide should only illustrate the highlights.

This is the first true slide of the pitch – your opportunity to hook the audience. Consider sharing an anecdote that allows your investors to relate to the pain point on a personal level.

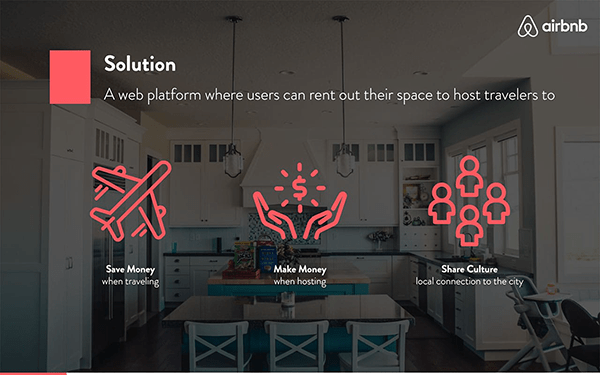

Clearly describe how your business solves or alleviates the pain points in the previous slide.

How do you serve your customers? What makes your business model different from other solutions?

You also need to translate to investors the value of solving the problem. Why should your investors want to be part of your solution?

In the Airbnb example below, this simple slide shows three significant ways Airbnb plans to serve their customers:

This clean slide is particularly effective because investors immediately realize the value with a brief glance at the content.

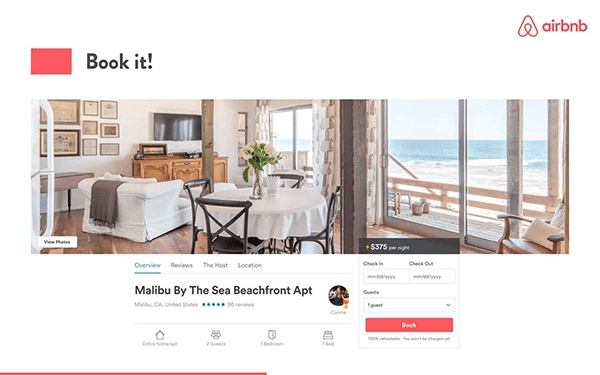

At this point, your challenge is to prove to the investors what you told them in the previous slide – that your solution is unique and special.

What is the “secret sauce” behind your idea that makes you different and more successful than everyone else? This may include special technology, a unique algorithm, a new manufacturing technique, or a singular customer experience.

In this slide, show investors the magic behind your business through diagrams, schematics, or illustrations rather than wordy descriptions. If you have a prototype or a demo product, use it.

This Airbnb example shows screenshots of the application, proving that booking a home in a foreign city is easier and more appealing than booking a hotel.

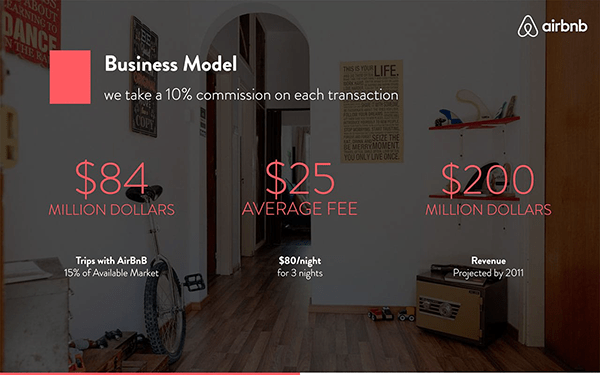

Investors need to understand how you plan to make money. This slide should pair closely with the next slide, when you will share the market size and opportunity for growth.

Help your investors understand who your customers are and how you will monetize them.

For example, Airbnb details that each booking results in a 10% commission to the company. The share that the average booking is $80/night for 3 nights, which results in an average commission of $25 per transaction.

This slide clearly shows investors what type of revenue to expect and begins to share how big the market is.

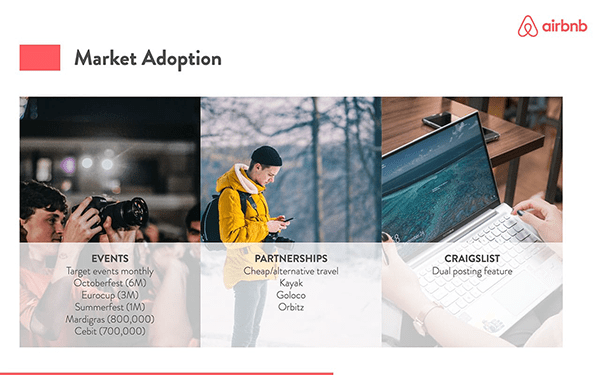

How are you going to reach your customers? Whether you plan to use partnerships with other brands, social media influencers, or door-to-door sales reps, clearly summarize this for your investors.

Be prepared to speak to the traction you have achieved so far.

Do not allude to a theoretical partnership with NASA or a viral marketing phenomenon that doesn’t exist yet.

Your go-to market plan differentiates you as a business and begins to prove to investors that you are a unique competitor in the field.

In the Airbnb example, they define three pathways to reach their customers and briefly bullet specific opportunities.

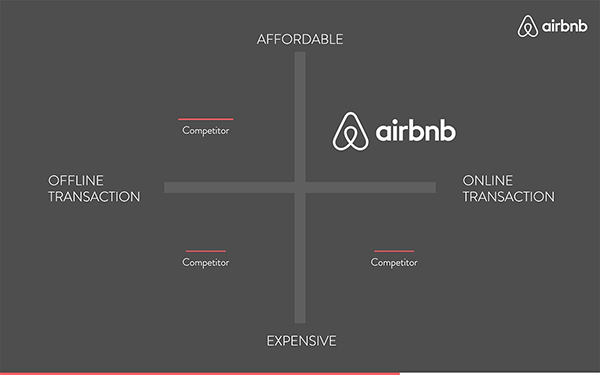

On this slide, you need to prove that you know who your competitors are and you know why you are better than them.

In the example below, this diagram instantly illustrates how Airbnb is more affordable and efficient than their competitors. Diagrams and charts will serve your business better than a wordy description.

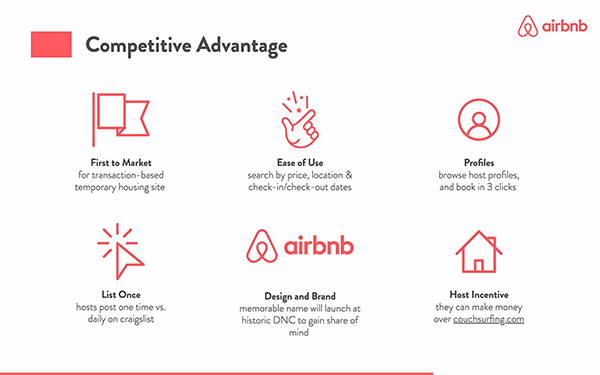

Airbnb included an additional slide about competitive advantage.

They touch on user incentives, user accessibility, and uniqueness as a platform in the space. This slide allows them another chance to reinforce their “secret sauce” to investors.

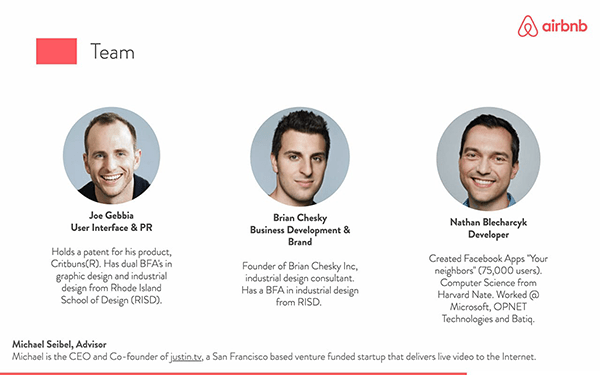

Tell investors why you are the right team for the job.

Headshots and career highlights are a given, but cater this description to your pitch and the industry space.

Perception is reality, and investors need to believe in their souls that your team can make this business successful, thereby making them money.

Keep the slide simple, but don’t neglect rehearsing this part of the presentation.

You may also want to include advisors, board members, or other major investors to give your team some additional clout.

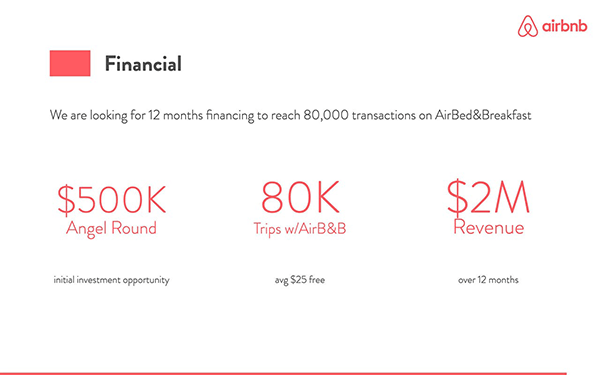

Show investors a low-risk path to a pot of gold.

Your finance slide may be the most important slide in your series A pitch deck. It should include three to five financial projections and showcase the revenue ramp. Also include key financial highlights, such as number of existing customers, pre-sales, and conversion rates.

Always share bottom-up projections and base projections on real numbers, whether you already have revenue flowing or not. Idea validation is a great way to show investors some numbers if your startup is too young to have cash flow.

Founders often extrapolate assumptions to prove wild projections to investors. Many Series A investors will immediately latch onto this common mistake and discredit the entire pitch as a joke.

Do not make this mistake.

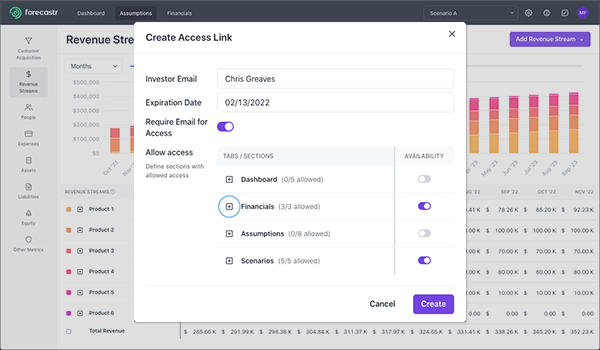

One of the best things you can do to prove to investors that your financial projections are sound is to have, and reference, a working financial model. With a tool like Forecastr, you can simply send investors a link to interact with your model and examine every assumption on their own or by your side.

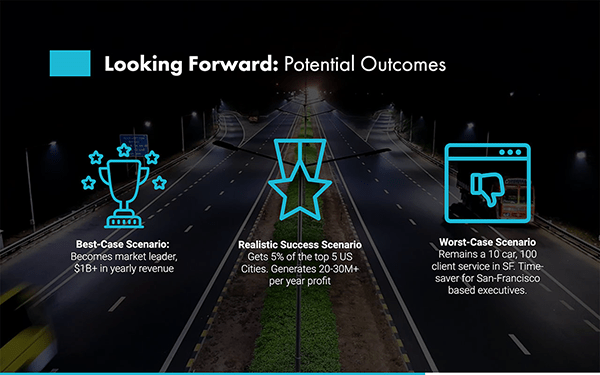

Before you wrap up the presentation, you have one last chance to showcase your startup’s present achievements and highlight the runway for tomorrow.

What have you accomplished so far? What is your immediate future? What are your next steps?

Investors should walk away from the presentation understanding how you will spend their money and how that will result in a return for them down the road.

This Airbnb example states the investment opportunity and how it will be mutually beneficial for the startup and the investors.

To show another approach, the slide below from Uber’s pitch deck details multiple scenarios where investor funding seemingly leads to inevitable success.

Leave your investors on a positive note – the next time you talk, they might be signing a check.

Get notified about new events, free resources, and fresh content

If you’re a founder preparing for your Series A funding, you might be feeling a bit overwhelmed. The list of things you need to do is growing rapidly...

A financial model can make or break your fundraise. Your model is the backbone of data behind what is otherwise a well-rehearsed pitch for a cool...

If you’re reading this, it’s probably because you asked the question, “What is a Series A?”